Prosperity with Purpose: positioning portfolios in a carbon-challenged world

In January, a relatively unknown Swedish 16-year-old school girl, known for striking on Friday in the name of climate change, addressed economic leaders in Davos with what has become known as the “our house is on fire” speech. A few days earlier, Jeremy Grantham pledged $1 billion towards fighting climate change.

As the year unfolded, the world saw an estimated 1.4 million children striking globally in March, and in April Mark Carney, Governor of the Bank of England, wrote an open letter on climate related-financial risks. Most recently, The Guardian has replaced ‘climate change’ with ‘climate emergency, crisis or breakdown’ and ‘global heating’ in place of ‘global warming’.

The world is listening, but on an individual level understanding what one can do is often overwhelming, particularly in the sphere of investing. Money can be invested so that it makes a difference, but navigating the jargon is confusing.

More commonly referred to as impact investing, the idea is that investments can be made into companies to generate a measurable social or environmental benefit, alongside a financial return. Impact investing is gaining traction but monitoring and measuring impact remains a challenge.

As we launch our 5th annual Impact Report Prosperity with Purpose1, it is clear that every pound counts. Our Impact Calculator2 now shows the impact of an investment over a one-, two- or three-year horizon, across WHEB’s nine sustainable investment themes.

We believe that the global economy is in the early stages of a major transition to a low carbon and more sustainable model. WHEB’s investment strategy is wholly-focused on listed companies that are enabling and benefiting from this transition.

At the end of December 2018, there were 58 holdings in the portfolio with each company categorised into one of nine WHEB investment themes, relating to seven of the 17 United Nations’ Sustainable Development Goals (SDGs). You can find more specific examples of our underlying investments relating to the relevant SDGs below.3

For the 12-month period ending 31 December 2018, £1 million invested in the strategy was associated with positive social and environmental impacts equivalent to:

- 800 tons of CO₂ equivalents (CO2e) avoided

- 1,800 MWh of renewable energy generated

- 200 tons of waste recovered or recycled

- 10 million litres of waste water treated

- 14 million litres of water cleaned and distributed for reuse

- 52 people received healthcare treatment

- 51 people benefited from preventative healthcare

- £65,000 of healthcare costs saved

- 118 days of tertiary education provided

Today, climate-related financial risks are firmly on many investors’ agendas. A significant proportion of the WHEB investment strategy is invested in companies, such as IPG Photonics, which manufacture and sell products and services that help to reduce greenhouse gas (GHG) emissions.

In 2018, we estimate that the overall strategy helped to avoid the emission of more than 218,000 tons of CO₂. This is equivalent to 800 tons of CO2e per £1 million invested in the strategy.4 Over a three-year period, the impact of £1 million invested would have avoided the emission of more than 3,400 tons of CO2e.

While these numbers seem significant, a critical question is whether these levels of avoided carbon are sufficient to limit global warming to no more than 1.5° Celsius above pre-industrial levels – a level that most scientists consider to be manageable.

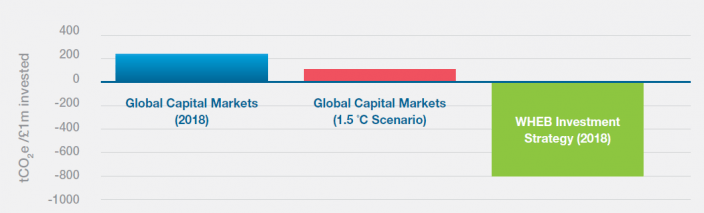

Figure 1 depicts the approximate levels of emissions that are associated with £1 million invested in today’s economy as well as the level of emissions, per £1 million invested, that would be commensurate with limiting global warming to no more than 1.5° Celsius above pre-industrial levels. The third column in the chart shows the quantity of carbon emissions that are avoided through an investment of £1 million in WHEB’s strategy.

Clearly, a progressive shift of economic activity towards the companies held in WHEB’s investment strategy would help limit greenhouse gas emissions to levels that are consistent with warming of no more than 1.5° Celsius.

In an absolute sense, however, the WHEB strategy is a minute proportion of the global economy. In 2018, the WHEB strategy represented approximately just one millionth (0.0001%) of global capital markets. As illustrated above, the strategy’s positive contribution is disproportionate in the context of the broader economy.

Of the GHG reductions required from 2018 emissions to achieve global warming of no more than 1.5° Celsius by 2030, the money currently invested in the WHEB strategy contributes approximately just under one basis point (0.01%) of this global annual reduction objective5,6.

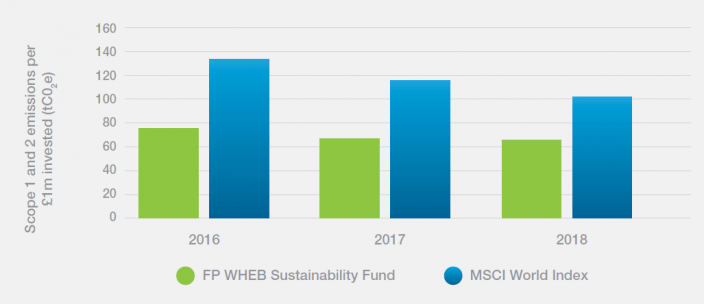

It is worth noting that the companies in the WHEB portfolio do use energy and produce GHG emissions themselves. This includes the direct production of emissions from their own operations (Scope 1 emissions) as well as emissions related to their use of electricity that has been generated through the burning of fossil fuels (Scope 2 emissions). Focusing purely on these operational greenhouse gas emissions, the strategy still compares favourably against the benchmark (see graph below).

In 2018, these emissions equated to 65 tons CO2e per £1 million invested in the strategy. This compares with 103 tons CO2e per £1 million invested in the whole market (as measured by the MSCI World Index).

The difference is a consequence of two factors. Firstly, the strategy has no exposure to heavy carbon emitting sectors such as the energy sector. Furthermore, the strategy has much greater investment, compared to the MSCI World, in low emitting sectors such as healthcare and information technology.

Secondly, the strategy is also invested in companies that are generally more carbon efficient than their peers within their sector. This is particularly true in the materials and utilities sectors with companies like DSM and Smurfit Kappa reporting significantly lower CO2e emissions than the materials sector average.8

This article has focused on our carbon efficiency, but for a full picture of the positive impact of the investments in the WHEB strategy, which includes social impact, download our 5th annual Impact Report, Prosperity with Purpose below.9

1 https://www.whebgroup.com/reporting-impact-investment/impact-reports

2 https://www.whebgroup.com/reporting-impact-investment/impact-calculator

3 https://www.whebgroup.com/investing-for-impact/our-portfolio

4 https://www.whebgroup.com/investing-for-impact/how-we-invest

6 Op. Cit. 3

7 Bloomberg and WHEB data

8 Op. Cit. 7

Photo © Niki Natarajan Artist: Jody Art