This article appears in our Q3 2019 Quarterly Report.1

Inequalities in health and consequent life expectancy are clearly visible between countries. As of 2015, average life expectancy in Japan was just under 84 years, while in Sierra Leone it was just over 50. But there are also massive differences in life expectancy within countries and even within cities. There is, for example, a 14-year gap in male life expectancy between the richest and poorest areas of Glasgow.2

These significant discrepancies in life expectancy exist even in countries, like Scotland, where there is free universal health coverage. The discrepancies persist because, for many communicable and non-communicable diseases (NCDs), acting at the point at which someone presents with a health problem to a healthcare professional can be too late. As a 2017 article in the British Medical Journal put it, ‘To improve health, reduce health inequalities and reduce costs on healthcare budgets, we need to improve the conditions in which people are born, live, work and age.’3

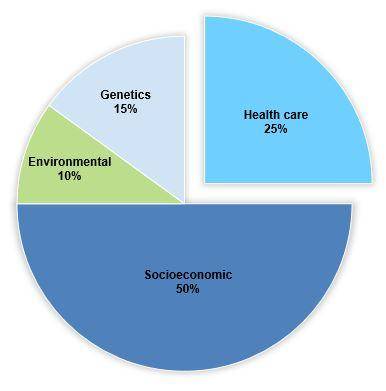

The extent of the importance of these ‘social determinants of health’ is not clear although it is clear that they are significant. Recent studies have found that social and environmental influences contribute between 45% and 60% of the variation in health status. A 2012 study by the Canadian Institute of Advanced Research found for example that 50% of an individual’s health status is likely to be derived from socioeconomic factors and 10% from environmental factors. The other influencers were genetics (15%) and healthcare (up to 25%).

International initiatives are trying to address the challenge

The world’s healthcare profession is already heavily invested in efforts to help address the social determinants of health. There have for example been several high-level initiatives aimed at raising the priority of these issues including through the UN (such as the Sustainable Development Goals) as well as the World Medical Association, the World Health Organisation and the General Medical Assembly. Many countries have also moved to prioritise social determinants of health in their healthcare systems including the US, through the National Prevention Strategy and State Innovation Models (SIM), that seek to improve health outcomes by moving the nation from a focus on sickness and disease to one based on prevention and wellness.

Preventative care as a contributor to positive health outcomes

Within WHEB’s Health investment theme, ‘Preventative care’ has for some time been a key focus. However, the importance of preventative care has been underlined in recent months by two stocks in the portfolio. CVS Health Corporation is a major player in the US healthcare system running a national network of pharmacies. CVS also offers insurance companies and other clients a ‘pharmacy benefit management’ (PBM) service that helps control the costs of healthcare therapies for their beneficiaries.

CVS bought the health insurance company Aetna in 2019 and in early June launched a new strategy which has preventative care at its core. This new strategy focuses on the development of ‘Health Hubs’ in communities across the US. These facilities will dispense traditional pharmaceutical and other healthcare products but will also provide healthcare advice and support to Aetna clients as well as to clients of other insurance companies. This additional primary-level care is aimed at helping keep people healthy and thus avoiding the significant costs associated with hospital admissions and other more acute healthcare interventions. The end clients benefit by staying health, the insurance companies benefit by having lower costs.

Exercise and diet

The other holding that directly addresses the social determinants of health agenda is Tivity Health. Tivity focuses on providing gym and fitness classes mainly to retirees across the US. Their main programme, called ‘Silver Sneakers’, is typically paid for by insurance companies who are strongly incentivised to ensure that their clients remain fit and healthy and, like CVS, avoid the major costs associated with hospital admissions. Also like CVS, Tivity made a major acquisition earlier in 2019 when they bought a business called Nutrisystem. Nutrisystem provides a range of ready-made, pre-portioned meals and snacks that help their clients keep daily calorie intake low, leading to weight-loss. Tivity believe that there are ample opportunities to take a combined package of exercise and diet programmes to their health insurance customers that will enable them to better manage the health of their beneficiary populations.

The strategies offered by CVS Health and Tivity Health are not unique in their respective industries, but they are still innovative and break new ground in offering preventative care options across the US. Given the pressures on healthcare systems in the US, and the opportunity that these strategies offer to deliver better healthcare outcomes at significantly lower cost, we are hopeful that they will prove successful.

2 https://www.gcph.co.uk/publications/621_glasgow_health_in_a_changing_city

3 Donkin A, Goldblatt P, Allen J, et al. Global action on the social determinants of health. BMJ Global Health, 2017

4 Canadian Institute of Advanced Research (2012) quoted in Op. Cit. 2