Engagement without the punch-ups

The mainstream media likes to report stories with drama. A ‘punch-up’ between fund managers and company executives over CEO remuneration makes for a good headline. But it doesn’t always have to be this way. This year, in our fourth Impact report we measured the positive impact of WHEB’s investments and this has served as a more positive basis for at least one strand of our engagement activities.

Calculating impacts relies on data

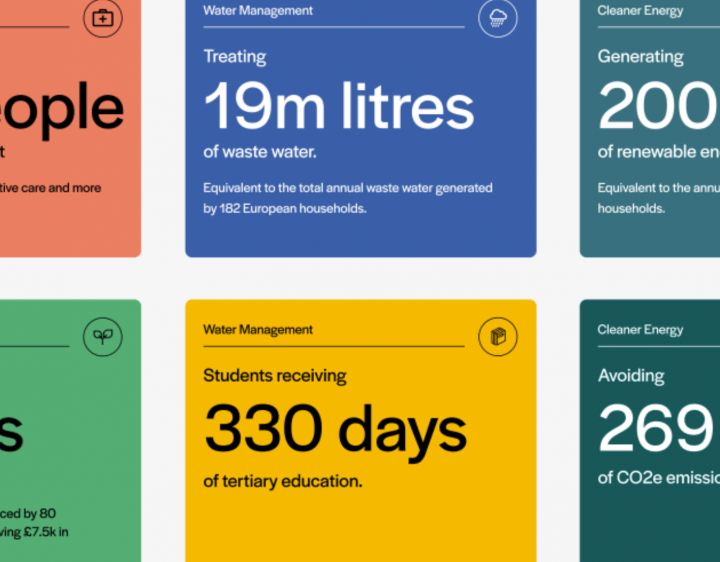

WHEB’s Impact calculator measures the positive impacts associated with any amount invested in the Fund over a year. The nine social and environmental metrics we measure and report on are derived from a bottom up analysis of each company held in the portfolio at the end of the year. The methodology1 involves a calculation of the outputs achieved by each company’s products. Then, based on the whole company’s impact, we determine the amount associated with the Fund’s shareholding. From there it is then possible to calculate the impact associated with each investor’s holding in the WHEB fund2.

However, while the impact calculation is possible, it is not complete. We were only able to get figures directly from company reports in 38% of the portfolio’s holdings. For a further 22% of the Fund, we were able to use numbers from industry peers or market share data to make an estimate. This leaves 40% of the portfolio out of the analysis altogether as neither option was available. For example, we are confident that Xylem, which is a manufacturer of water treatment technologies, contributes to the cleaning and reuse of a vast volume of water around the world, but we don’t have any data to underpin this. Equally MSA Safety, a manufacturer of self-contained breathing apparatus for fire-fighters, helps to save many hundreds of lives, but again there is no data on the actual number. A key target for us as we continue to evolve our impact reporting, is to improve the coverage, accuracy and relevance of the impact calculator year on year. To do that, we need the companies we invest in to help us.

Pushing on an open door

We have sent letters along with copies of WHEB’s impact report to all our investee companies encouraging them to invest in the analysis, measurement and communication of each of their impacts. The message they should be hearing should be a really encouraging one. Only 16% of the MSCI World Index meets WHEB’s investable universe definition of providing a “solution to a sustainability challenge”. We only select a company for our portfolio on the basis that we believe it has a positive overall impact on society or the environment. We think that this is good for their long-term growth and profitability, so they should be proud of this and their achievements should be worth promoting, and not just to investors, but to all stakeholders in their business. Information about the value created for society can only have a positive effect on relationships with customers, employees, regulators and civil society.

The responses so far have been varied, ranging from (stunned?) silence to quite sophisticated. In many, perhaps most, cases this is the first time that they have been asked to think in this way. Some have misunderstood this to be yet another request for more ESG reporting on their internal policies and processes. So we are having to explain our more fundamental interest here in trying to work out how to measure the positive externalities associated with their products. In many cases the question presents some methodological challenges. How should we quantify the benefit of computer aided design software that is used to improve the efficiency of wind turbine blades, in terms of reduced carbon emissions or renewable energy generated? Others have understood very quickly what we are trying to get at. This sort of information has rarely been asked for by investors before, so it is often not readily at hand.

We don’t expect to have 100% coverage in next year’s impact calculator, but we do hope to make some progress. And along the way we hope we will have put the measurement of positive impact on the table for our investee companies. It is a quite an enjoyable way to start a conversation… “Congratulations, we think your company is making a contribution to a more sustainable future. Please will you help us to quantify this!?”

1 The methodology is available on our website at https://www.whebgroup.com/impact/methodology/

2 WHEB’s impact calculator can be used to calculate the impact associated with a given level of investment in the FP WHEB Sustainability Fund at https://www.whebgroup.com/impact/impact-calculator/