Supporting positive outcomes

At WHEB, we believe it's our responsibility to use our influence within the wider financial system to support and enable more positive social and environmental outcomes.

How do we do this? Not just through our engagement and reporting with clients and their advisers, but also with regulators, policymakers and standard setters.

We think of our involvement a little bit like this: a single football fan would struggle to claim it was their singing - and not the thousands around them - that inspired their team to win the game. But, as a community all singing together, the fans create an atmosphere that has a clear bearing on the outcome of a game.

This is how, together with a network of other like-minded businesses, we can change the financial system to make sustainability a priority.

As a business, WHEB is a signatory to a number of industry initiatives that align with our long-term view and support sustainable investing. Our role may vary, depending on the organisation, but it often involves sharing information and ideas, contributing to the development of standards and best practice and also hosting or participating in conferences.

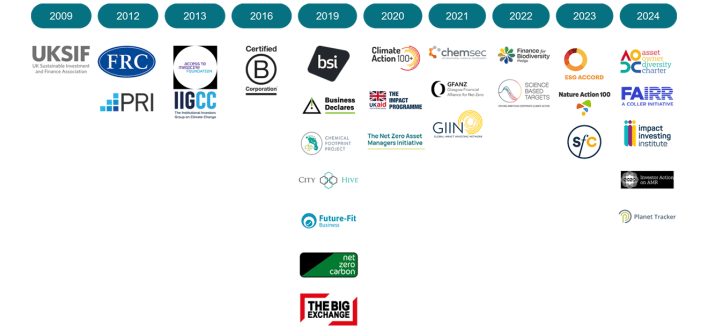

Timeline of our industry networks

Access to Medicines Foundation

WHEB is a signatory and has worked as part of an investor collaboration to promote action by pharmaceutical and related businesses since 2013.

Asset Owner Diversity Charter

WHEB is pleased to participate in the Asset Owner Diversity Charter from 2024 as we believe it is important to build an investment industry which embodies a more balanced representation of diverse societies.

B Corps

WHEB Asset Management has been a Certified B Corporation since 2016. George Latham, Managing Partner, is a B Corp Ambassador. Katie Woodhouse and Laura Grenier are co-leads on a Net Zero working group.

British Standards Institute (BSI)

This is the UK’s national standards body responsible for creating standards on sustainable finance among many other areas. WHEB has been represented on a variety of technical committees developing specifications on sustainable finance with BSI since 2019.

Business Declares

WHEB was one of the first businesses to declare our support for the Business Declares network in 2019. In setting out WHEB’s action plan, we aim to support the community of businesses taking urgent action to tackle climate change. Furthermore, we commit to advocate to other business leaders the importance and value of joining this movement at such a critical time.

CFA Institute Asset Manager Code

WHEB is compliant with the Code, which outlines the ethical and professional responsibilities of organizations that manage assets on behalf of clients. It provides standards and supportive guidance based on general principles of conduct.

Chemical Footprint Project

An NGO-led initiative focused on eliminating hazardous chemicals from global supply chains. WHEB is a signatory since 2019 and is involved in collaborative engagements with companies (e.g. First Solar).

ChemSec

WHEB has been a member of the ChemSec-supported Investor Initiative on Hazardous Chemicals (IIHC) since 2021 and has led engagements with Ecolab and Linde. ChemSec, the International Chemical Secretariat, is an independent non-profit organisation that advocates for substitution of toxic chemicals to safer alternatives.

City Hive

WHEB was pleased to be a founding corporate member of City Hive in 2019. We're also a founding signatory of City Hive's Action, Culture and Transparency (ACT) framework, which is a standard of corporate culture that captures the essence of an investment management company’s ‘heart and soul’ and provides professional investors with a framework to assess, measure and be a catalyst for change.

Climate Action 100+

This is a collaborative engagement initiative focused on major carbon emitters. WHEB is involved in collaborative engagement initiatives with companies (e.g. Daikin) and has worked with the CA100+ since 2020.

ESG Accord

WHEB are a founding partner of the Accord Initiative from ESG Accord that launched in July 2023. A suite of compliance, education, CPD and Regulatory analysis services that provide everything financial advisers need to build ESG and Sustainability into their advice process.

FAIRR

WHEB joined FAIRR in May 2024. FAIRR works with over 400 investors to look into ESG risks and opportunities within the food sector, specifically focusing on animal agriculture.

Finance for Biodiversity Pledge

Pledge signatories call on global leaders and commit to protecting and restoring biodiversity through their finance activities and investments. WHEB became a signatory in December 2022.

FRC Stewardship Code

WHEB successfully became a signatory to the revised 2020 UK Stewardship Code in March 2022. We were a signatory to the previous version of the Stewardship Code from 2012 and were awarded ‘Tier 1’ status when the FRC began grading applicants in 2016.

Future Fit Business

The Future Fit business benchmark is a strategic management tool for companies and investors to assess, measure and manage the impact of their activities. Seb Beloe has been a member of the Development Council since 2019.

Glasgow Financial Alliance for Net Zero (GFANZ)

GFANZ is a global coalition of leading financial institutions committed to accelerating the decarbonization of the economy. WHEB became a member in 2021 through our work with the NZAMI.

Global Impact Investing Network (GIIN)

A not-for-profit network dedicated to increasing the scale and effectiveness of impact investing around the world. WHEB has been a member and part of the Working Group defining guidance for impact investing in Listed Equities since 2021.

Impact Investing Institute

The Impact Investing Institute works to increase awareness and interest in impact investing. WHEB is pleased to support their work.

Impact Management Project

WHEB has been an active contributor since 2020. This is a forum for organisations to build consensus on how to measure, compare and report impacts on environmental and social issues.

Institutional Investors Group on Climate Change (IIGCC)

WHEB has been a signatory and member of the Policy Group since 2013. We have also been active in formulating the Paris Aligned Investment Initiative and a participant in the NZEI (Net Zero Engagement Initiative) since its launch in March 2023.

Investor Action on Antimicrobial Resistance (IAAMR)

In April 2024, WHEB became an investor partner of IAAMR, which is a coalition between the Access to Medicine Foundation, the FAIRR Initiative and the UK Government Department of Health and Social Care to galvanise investor efforts to address global antimicrobial resistance.

Nature Action 100

WHEB joined in 2023 and is working alongside 190 investor participants to directly engage with 100 companies in key sectors around the world and drive the necessary corporate action to reverse nature loss.

Net Zero Asset Managers Initiative (NZAMI)

An international group of asset managers committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner. In 2020, WHEB became a founding signatory.

Net Zero Carbon 10/20

NZC20 is an initiative focusing on delivering absolute carbon reductions at the fund level. WHEB is a founding signatory of it's first phase, NZC10, in 2019 and participates in events aimed at promoting the standard.

Planet Tracker

WHEB joined think tank Planet Tracker in 2024, to call on petrochemical companies to transition to safe and environmentally sound practices, by reducing fossil fuel dependency and eliminating hazardous chemicals in plastics.

Responsible Investment Association Australasia (RIAA)

Responsible Returns is an initiative of the RIAA, which champions responsible and ethical investing in Australia & New Zealand. It operates the world's longest running Responsible Investment Certification Program. The Pengana WHEB Sustainable Impact Fund has been certified since 2017.

Science Based Targets initiative (SBTi)

In 2022 we committed to having our net zero targets verified by the SBTi.

Shareholders for Change

In April 2023, WHEB joined Shareholders for Change, a European network of institutional investors involved in active engagement with corporations to enhance a common social agenda as an essential element of their role as shareholders.

The Big Exchange

WHEB joined as a founding partner in 2019, and Seb Beloe is a member of the impact advisory board of this pioneering new investment platform launched by Big Issue Invest. The FP WHEB Sustainability Impact Fund has retained its gold medal in the latest fund assessment.

UK Sustainable Investment and Finance Association (UKSIF)

WHEB has been a member since 2009 and is regularly involved with events and initiatives including for example in helping to develop responses to the UK Government’s sustainable finance proposals (e.g. the Sustainability Disclosure Requirements).