Articulating a theory of change for our investments

With the growth of ESG investing, impact investors have sought to establish core elements that differentiate impact strategies from the vast range of other investment products labelled as ‘ESG’ or ‘sustainable’.

One of these elements is the ‘theory of change’ that is often implicit within an impact investment strategy. The theory of change is typically connected with a ‘problem statement’ and sets out the mechanism by which a given investment positively impacts upon the problem.

The importance of clearly articulating a theory of change has been given added emphasis in recent months by the publication of draft guidance from the Global Impact Investing Network (GIIN).[1] Developed by a working group of which WHEB was a part, this document sets out the GIIN’s view on what characteristics define an investment in listed equities as being an impact investment.

The ‘intentionality’ of making investments that contribute to positive social and environmental impacts remains central, but the draft guidance also highlights the importance of setting out a theory of change that describes ‘a sequence of cause-and-effect actions or occurrences that the investor believes will accelerate as a result of their actions and will contribute to a set of targeted social and environmental results’.[2]

Figure 1 below shows how conceptually a company takes inputs in the form of materials, capital and labour and through its activities transforms this into output products and services which have a positive impact that in turn lead to positive outcomes.[3]

WHEB’s theories of change

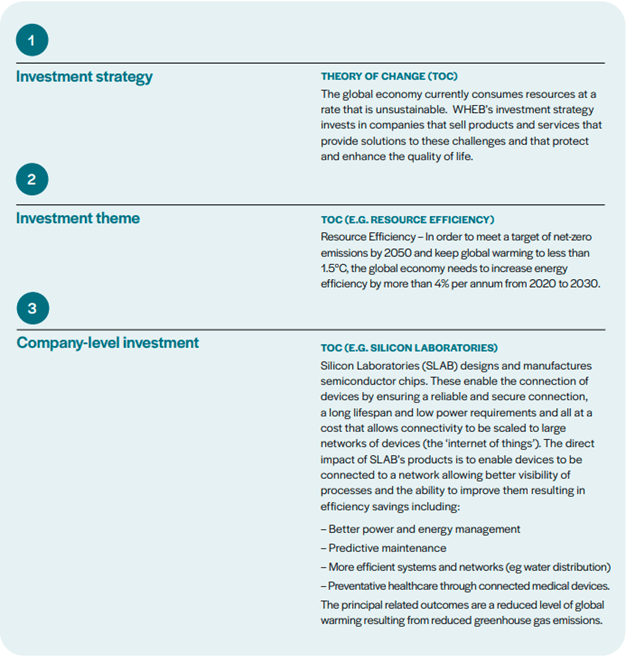

At WHEB, we articulate a theory of change for our investment strategy. This is necessarily high-level as it embraces a variety of investment themes. More importantly though, in our view, is that we also provide a clear theory of change for each of our nine investment themes which are also evident at the level of each portfolio holding.

For WHEB’s investment strategy, our theory of change states that ‘The global economy currently consumes resources at a rate that is unsustainable. WHEB’s investment strategy invests in companies that sell products and services that provide solutions to these challenges and that protect and enhance the quality of life’.

Underneath this headline theory of change, the strategy has nine social and environmental investment themes. Each of these is associated with an explicit theory of change or problem statement that the investment theme is related to as well as a company-level theory of change that describes how each individual investment delivers solutions to the problem through the impact of its products and services. An example is provided in figure 2 below. In addition, WHEB’s latest impact report, published in late June, includes detailed problem statements for each of WHEB’s nine investment themes. The report also discloses how each of the strategy’s holdings aligns with these nine themes.[4]

Next steps

At WHEB we are convinced that impact investing has distinctive characteristics that differentiate it from other types of ESG strategy. We also agree with the GIIN that a clear theory of change for investments is one of these characteristics.

The GIIN guidance is still a draft, but we expect that the finalised version will be influential in helping market participants differentiate between impact investors and those investors that take ESG issues more generally into account in their investment processes. The guidance may also help inform the development of regulation, for example in the definition of fund labels.[5] We would encourage clients to provide feedback to the GIIN during the consultation process that is set out in the draft guidance.

[1] https://tinyurl.com/3yczcbd6

[2] Ibid

[3] Unhelpfully, definitions of ‘impact’ and ‘outcomes’ are not consistent within the industry. Some frameworks switch the order in figure 1 with outcomes leading to final impacts

[4] For example the FSA initial discussion paper on Sustainability Disclosure Requirements (SDR) and investment labels proposed ‘impact’ as one potential label (https://www.fca.org.uk/publication/discussion/dp21-4.pdf)

[5] See pages 24-25 at https://impact.whebgroup.com/media/2022/06/20220623-WHEB-Annual-Impact-Report-2021.pdf