WHEB produced our first impact report in 2015. We believe that we were the first listed equity manager to produce one. With our 11th report, again we believe we’re the first to produce a report that meets the requirements of the ‘product-level’ disclosure under the Sustainability Disclosure Requirements (SDR).

As well as providing robust data on the impact of the Fund, we have tried in this year’s report to present a stronger narrative, recounting the ‘story’ of the Fund in 2024. We feel that providing narrative alongside data is an important innovation that connects investors more closely to the Fund and one that we hope others in the industry will adopt. To this end, we have been convening our peers, as well as clients, consultants and data providers to support the development of best practices in impact reporting. This has included hosting our own roundtable as well as working with the Impact Investing Institute1.

A challenging environment for sustainability investment

As investors will no doubt already know, 2024 contained more than its fair share of challenges for impact investors. Enduring excitement about the potential for AI to reconfigure activity across the global economy led to outsized returns from companies exposed to AI infrastructure. These companies deploy undifferentiated AI infrastructure and are not sufficiently exposed to positive impact applications to be investable in by the Fund. They also come with a hefty carbon footprint – currently with an 18% compound annual growth rate (CAGR) and doubling approximately every four years.

The WHEB strategy also suffered from on-going negative sentiment towards sustainability generally. There has been a dramatic reversal in the sustainability optimism of just a few years ago when governments and businesses were committing to net-zero carbon (NZC) targets.

Since then, the world has seen a war in Europe, skyrocketing inflation, a cost-of-living crisis, a supply-chain crisis, and the re-election of Donald Trump as US president. Together the economic challenges created by these events have undermined momentum for a greater focus on sustainability. And meanwhile, underlying sustainability challenges have compounded with climate change as the stand-out example of this.

Rolling with the punches

With this very negative back-drop the WHEB strategy has been cautious about the more volatile and highest impact parts of our investment universe. For example, we reduced our exposure to residential solar and heat pump markets both of which have suffered as demand has declined under the weight of higher interest rates and lower government support.

Instead, through our bottom-up process we have been adding to steadier parts of the market which are less exposed to these dynamics. For example, the Fund’s weighting in areas like Water Management and Safety have risen progressively from less than 15% of the strategy historically to more than 25% at the end of 2024.

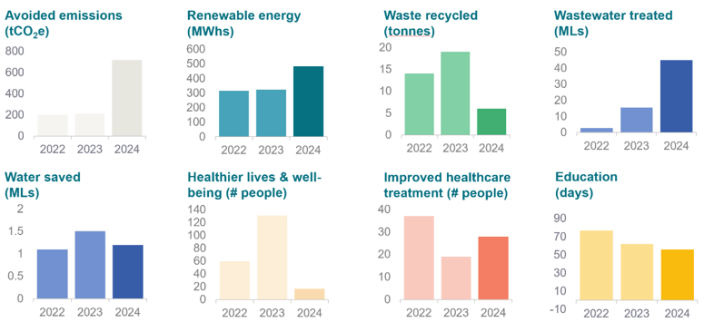

Notwithstanding this shift in emphasis in the portfolio, our positive impact remains at a very high level as demonstrated by data in our impact calculator. Figure 1 below shows the impact associated with an investment of £1m in the Fund from 2022-24. Higher impact in avoided emissions and renewable energy is primarily driven by the improving economics of these technologies with more positive impact being delivered at lower unit cost. In other areas such as wastewater treated and education, year on year changes are primarily due to shifting weights in the Fund as described above.

Figure 1: Impact per £1m invested (2022-24)2

Donald Trump was elected President of the United States for a second time on the fifth of November last year, although it seems like years ago now. Shortly after, we wrote about what it would mean for sustainable investors; you can read that here. We also talked about the implications in our fourth quarter 2024 webinar update, shortly after his inauguration. This slide from that presentation summarised our thoughts then:

Foundations for recovery

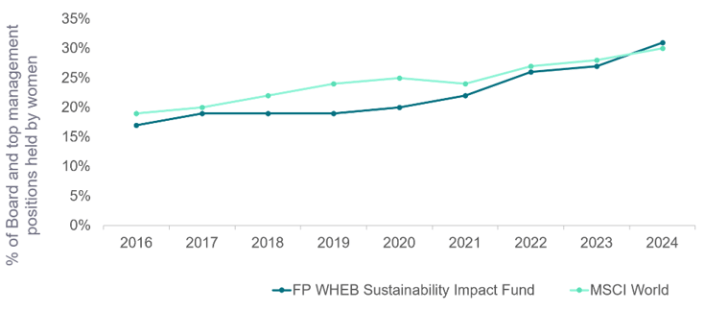

Alongside the continued focus on positive impact, we have also sought to retain the high quality characteristics of the portfolio. We see management of material ESG issues as supportive of commercial success and engage proactively with management on these issues. In 2024, for example, we were pleased to see this focus contribute to significant improvements in both diversity and carbon emissions across the portfolio including exceeding the MSCI World on both measures and achieving one of our net-zero carbon commitments a year early.

Figure 2: Sustained improvements in gender diversity3

Well-positioned for a return to growth

Stock markets are prone to cyclical behaviour. And just as the market was overly optimistic about the prospects of sustainability focused assets in 2021, in our view it is overly negative today. The first cleantech cycle which peaked in the late 90’s burst along with the wider tech bubble at that time. This happened again in 2008 when cleantech stocks peaked before following the rest of the market into the global financial crisis. In both cases the sector came back bigger and stronger.

We are confident that the same will happen here. In fact, we think the prospects are much better this time because returns will not be driven so much by policy, but by economics. While market and political headwinds facing sustainability have been dominant over the past few years, the performance and competitiveness of the underlying technologies has continued to improve.

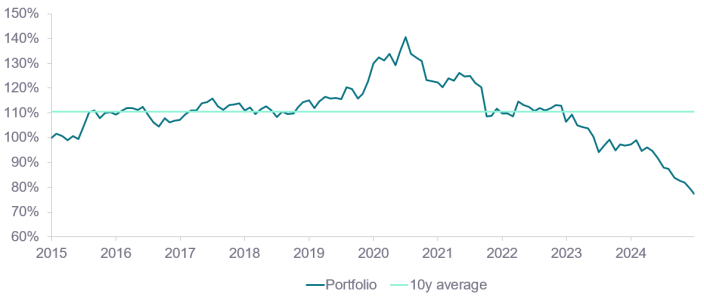

Our contention is that stock market prices do not fully reflect the competitiveness and strong potential for the companies providing these technologies. In fact, for the WHEB portfolio as a whole, the valuation is on some measures the lowest it has been for over ten years (Figure 4).

Figure 4: Portfolio price to forward book ratio, relative to local markets, rebased4

Mark Twain once said after reading his own obituary in a newspaper that rumours of his death had been “greatly exaggerated”. We feel the same way about sustainability and impact investing. Some commentators are already writing their obituaries for sustainability investing, but surveys routinely and consistently find undimmed demand amongst savers and pension beneficiaries for these types of investments; an appetite that is particularly pronounced among women and younger investors.

Meanwhile, we believe that the markets that we invest in are overdue a recovery. The Fund is invested in companies that are trading at highly attractive valuations and that possess high quality franchises selling products and services that offer compelling economic benefits as well as positive social and environmental impacts. It is these companies that we believe are ideally placed to convert accelerating revenue growth into strong financial returns for our investors.

WHEB is also now part of Foresight Group - a stronger and much larger business that is focused on investments that enable the transition to a zero carbon and more sustainable economy. We are excited about the next few years and believe that the prospects for investing in sustainability have not looked this good for at least a decade.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 https://www.impactinvest.org.uk/our-work/helping-investors-have-a-positive-impact/asset-managers/

2 Source: Net Purpose / WHEB

3 Source: Impact Cubed / WHEB

4 Figures reported are the mean ratio of price to next reported book value by analysts’ estimates, FP WHEB Sustainability Impact Fund, excluding distortions from meaningless denominator in the case of Autodesk. Source: Factset as at 22/4/25.