Originally from Hong Kong, I am used to hot summers consistently above 30°C but I have never known a day exceeding 40°C. Who would have thought that I would first experience such heat in London this July? We have seen record-breaking heat waves across the US, Europe and Asia this summer. Most people would turn on their air conditioning (AC) units when temperature reaches 40°C, if they have one. However, space cooling is energy intensive. The use of air conditioners and electric fan accounts for about 16% of the total electricity used in buildings globally.1 The energy consumption of space cooling is set to grow dramatically due to urbanisation and a growing middle class, particularly in emerging markets. On top of this, climate change is expected to turbo-charge growth in AC. If this is left unchecked, energy demand from air conditioners is expected to more than triple by 2050 according to the International Energy Agency (IEA).2

Energy efficiency in air conditioning

Part of the solution lies in improving the efficiency of air conditioners. Even though efficient technologies are already available, consumers are slow to adopt more efficient AC units due to higher prices. Besides improving efficiency, it is also possible to make air conditioners more climate-friendly by using refrigerants with a lower global warming potential (GWP).

As impact investors, WHEB has been investing in manufacturers which promote the use of more climate friendly air conditioners for many years. One example is Daikin. Daikin has developed its own refrigerant R-32, which has a much lower GWP than most commonly used refrigerants in the market. It also won the Global Cooling Prize in 2021, which encourages the design of small AC units with five times less climate impact than market-average models.

AC no longer a ‘luxury’

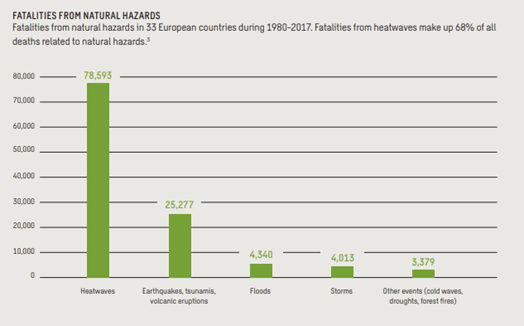

While some people may still see AC units as luxury or discretionary items, this is unlikely to remain the case as heat waves become more and more frequent. Extreme heat is deadly and the consequences can be dire. More Europeans died from heat waves than from all other natural disasters combined during the period from 1980-2017. More than 70,000 people died from the 2003 heat wave in Europe. It is estimated that in the UK deaths from heat could triple by 2050.3

Due to climate change, access to air conditioning has become an urgent public health issue. Nevertheless, among the world’s population living in a hot climate, only 12% own an AC unit.4 Unsurprisingly, lower income countries have significantly lower air conditioner ownership. Socially disadvantaged populations are also more likely to suffer from heat waves due to the lack of access to air conditioning.

Is air conditioning a solution?

However, is air conditioning the solution to the public health issue despite its intensive carbon footprint? Clearly innovations that improve the energy efficiency of AC will help, and WHEB only invests in companies offering these more efficient systems, but there are many other things that can be done to cool cities and communities. Planting trees in cities can help reduce the urban heat island effect and reduce peak summer temperatures by between 1 and 5°C while at the same time capturing carbon dioxide.5

Better city designs and more sustainable buildings also help keep heat waves at bay. The IEA estimates that well-designed cities could save up to 25% of the energy used for heating and cooling. WHEB invests in two environmental consulting companies Arcadis and Sweco. These companies have been working with local governments and municipalities to help cities adapt to extreme weather events and design more resilient buildings.

Besides installing air conditioners, there are other things that can be done to keep buildings cool during the summer months. Most people think insulation is only used to keep homes warm during the winter but it works both ways. Insulation theoretically helps keep buildings cool although its effectiveness depends on a lot of factors including the number of windows and heat radiating home appliances. Heat pumps can be a better option than air conditioners. Heat pumps provide both heating and cooling. While the efficiency of heat pumps is more or less the same as air conditioners in the cooling mode, heat pumps are much more energy efficient for heating. Heat pumps typically use up to 75% renewable energy sources (the ambient energy in the surrounding area). According to IEA, heat pumps could save 50% of the building sector's total CO2 emissions.

All in all, air conditioners are not a panacea for the public health issues caused by heat waves. Increasing the use of air conditioners without proper consideration of the associated climate impact would only exacerbate the issue. A more holistic approach would take both social and environmental aspects into consideration. More work needs to be done to incentivise the development of and shift towards more energy efficient air conditioners. There are also various low-carbon solutions which offer a better path towards a more sustainable world.

1 IEA (2018), The Future of Cooling, IEA, Paris https://www.iea.org/reports/the-future-of-cooling

3 https://www.bbc.co.uk/news/science-environment-62179678

4 IEA (2018), The Future of Cooling, IEA, Paris https://www.iea.org/reports/the-future-of-cooling

5 https://www.epa.gov/heatislands/using-trees-and-vegetation-reduce-heat-islands