US politics sends shockwaves through the renewable energy sector

Markets love to react, and sometimes in ways not immediately predictable. The recent attempted assassination of Donald Trump had immediate ramifications for the renewable energy sector. Following the incident, Trump's poll numbers surged, leading to significant volatility in renewable energy stocks. On the first trading day after the attack, shares in wind and solar companies experienced sharp selloffs.

This knee-jerk reaction stemmed from investor concerns about Trump's stance on renewable energy and his determination to dismantle the multi-billion-dollar government subsidy program for green energy, which he has recently criticised as the “green new scam."

Risks of repealing the Inflation Reduction Act

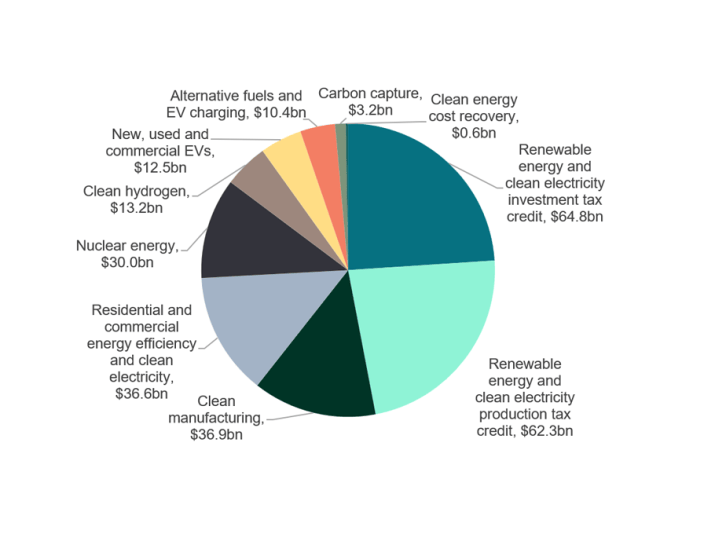

Among the key green policies in the US, the Inflation Reduction Act (IRA) is a pivotal piece of legislation signed by the US President Biden in August 2022. The IRA offers substantial tax credits to incentivise renewable energy projects.

Figure 1: Green tax credits in the Inflation Reduction Act1

Trump has pledged to repeal the IRA if he is re-elected. However, examining Trump's previous tenure reveals a pattern of unfulfilled promises. For instance, Trump's effort to repeal and replace the Affordable Care Act (Obamacare) during his presidency was unsuccessful.2 This example suggests that even if Trump aims to dismantle the IRA, he may face significant obstacles.

Repealing the IRA would require not just a "Republican sweep" – control of both the presidency and Congress – but also by a healthy margin. A divided Congress or a narrow Republican majority would likely hinder efforts to fully repeal the IRA, similar to the challenges Trump faced in overturning Obamacare with a slim majority during his first term.

This is partly because the current Republican Party is marked by internal rivalries and squabbling. In Trump’s first Presidency, their attempts to pass legislation were painful to watch.

It is also because the IRA has benefitted Republican-voting “red” states significantly by driving investments in renewable energy manufacturing facilities.3 These investments have led to job creation and economic growth in these regions. Consequently, an attempt to repeal the IRA could provoke internal conflict within the Republican Party.

Positive global climate policies

Despite uncertainties surrounding the IRA, global climate policies remain favourable. The recently elected Labour government in the UK has pledged to establish a publicly owned green energy company, Great Britain Energy, to boost clean energy investments. The UK aims to double onshore wind capacity, triple solar power, and quadruple offshore wind capacity by 2030.4 The UK is the second-largest offshore wind market globally, making its expansion a significant growth driver for the sector.5

Similarly, China has pledged to accelerate its renewable energy capacity, targeting 1,200 gigawatts of wind and solar power by 2030.6 With rapid investment in renewable energy, China is on track to meet this goal by the end of this year, six years ahead of schedule.7 These global commitments underscore a broader trend towards increased renewable energy investments and supportive policies.

Market dynamics in the renewable energy sector

Beyond climate policies, the fundamental dynamics of the renewable energy market play a crucial role. Renewables have become the cheapest form of power in many regions due to substantial price declines over the past few decades.8 Solar energy, in particular, has reached a tipping point where further deployment no longer requires more ambitious policies.9

However, several challenges continue to hinder renewable energy adoption:

- Supply chain disruptions: The global supply chain has experienced significant disruptions since the COVID-19 pandemic, affecting the availability and cost of renewable energy components.

- Lengthy permitting processes: Bureaucratic delays and lengthy approval processes have slowed the development of many renewable energy projects.

Grid infrastructure bottlenecks: Existing grid infrastructure in many areas is inadequate to handle the influx of renewable energy, requiring substantial upgrade

Efforts to address industry challenges

There are encouraging developments addressing these challenges. Many countries are implementing fast-track permitting processes and reducing bureaucratic hurdles for renewable energy projects. For instance, Germany has introduced reforms to expedite the approval process10, while Spain has streamlined its regulatory framework.11

In May this year, the European Commission introduced the Net Zero Industry Act, designed to support clean energy industries in the bloc by cutting red tape and accelerating permitting procedures.

Additionally, there is growing recognition of the need for significant investments in grid infrastructure to accommodate renewable energy sources

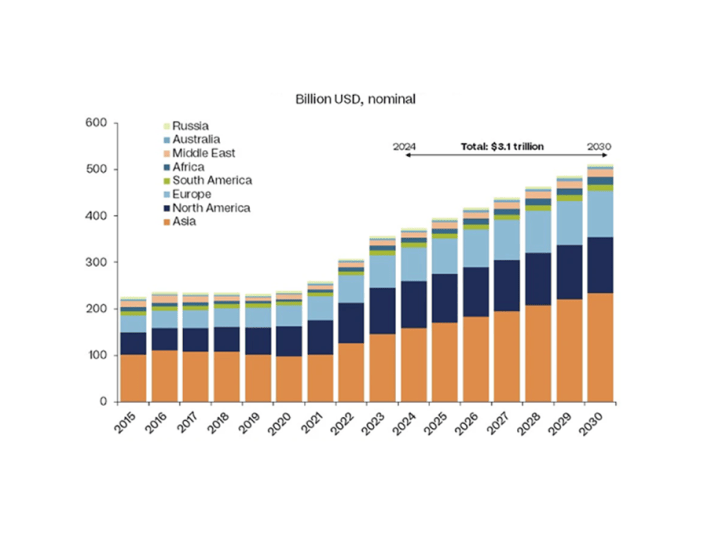

Figure 2: Power grid investments by region12

Several countries are committing substantial resources to upgrade their grids:

- United States: Under the Bipartisan Infrastructure Law (a.k.a. the “Infrastructure Investment and Jobs Act – another Biden bill, but much less contentious), the US has allocated over $65 billion to modernise its power infrastructure, marking the largest investment in clean energy transmission and grid improvements in American history.13

- China: China is investing heavily in its grid infrastructure, including the development of ultra-high voltage transmission lines to efficiently transport renewable energy from remote regions to urban areas.14

- Australia: Australia is investing AUD 20 billion in the “Rewiring the Nation” program to upgrade its electricity grid and better integrate renewable energy sources.15

Portfolio positioning and outlook

With over a decade of experience investing in renewable energy, we understand that policy and regulatory changes will not resolve all sector issues overnight. Given the sector's volatility ahead of the US election, we have adjusted our exposure to the Cleaner Energy theme.

We remain selective in our investment choices, reflecting the competitive dynamics within each sub-sector of the renewable energy market. For example, we have sold our position in SolarEdge, which focuses on residential and commercial solar markets, while retaining our investment in First Solar, which targets the utility market.

The renewable energy sector is likely to experience continued volatility leading up to the US election and when it arrives, we do expect a sharp move one way or another. We are of course mindful of the risk of a Republican sweep but the recent nomination of Kamala Harris has changed the odds according to the latest polls.16 In the event of a divided Congress, renewable energy stocks could see a sharp rebound, as the market may have overreacted to the potential repeal of the IRA under a Trump presidency.

With a longer term lens though, we see that renewables growth will more depend on addressing current challenges such as supply chain disruptions, permitting delays and grid infrastructure constraints. With supportive global policies and a compelling cost advantage, we are backing clean energy to come through those challenges.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 Congressional Budget Office

2 https://www.politico.com/news/magazine/2022/04/26/gop-obamacare-aca-health-care-00027585

3 https://www.ft.com/content/06fcd3dd-9c39-48d3-bb08-6d75d34b5ed1

4 https://labour.org.uk/change/make-britain-a-clean-energy-superpower/

5 https://www.thecrownestate.co.uk/news/uk-offshore-wind-industry-gearing-up-for-a-new-era-of-sustainable-growth

6 https://dialogue.earth/en/energy/china-can-benefit-from-a-more-ambitious-2030-solar-and-wind-target/

7 https://esgnews.com/china-dominates-global-wind-and-solar-energy-construction/

8 https://www.irena.org/news/pressreleases/2022/Jul/Renewable-Power-Remains-Cost-Competitive-amid-Fossil-Fuel-Crisis

9 https://www.anthropocenemagazine.org/2023/10/the-world-has-already-crossed-a-solar-tipping-point/

10 https://www.euronews.com/green/2023/01/31/wind-and-power-projects-in-germany-could-be-approved-faster-under-new-measures

11 https://www.fieldfisher.com/en/locations/espana2/actualidad/new-legal-developments-in-the-permitting-of-wind-a

12 Based on 1.8 degrees Celsius global warming scenario. https://www.rystadenergy.com/news/power-grids-investments-energy-transition-permitting-policies

13 https://www.whitehouse.gov/briefing-room/statements-releases/2021/11/06/fact-sheet-the-bipartisan-infrastructure-deal/

14 https://safety4sea.com/wp-content/uploads/2024/04/DNV-Energy_Transition_Outlook_China_2024_04.pdf

15 https://www.dcceew.gov.au/energy/renewable/rewiring-the-nation

16 https://theconversation.com/kamala-harris-edges-ahead-of-donald-trump-in-national-polls-for-us-election-235187