I first came across heat pumps while studying for my undergraduate degree in Environmental Science in the early 1990s. The technology has developed dramatically since then but still relies on the ‘magic’ of extracting heat from thin air.

How do heat pumps work and why are they important?

Heat pumps are found in everything from clothes dryers to electric cars. They are also increasingly common in buildings. A heat pump is a device that captures heat from outside a building and moves it inside to provide warmth. Everything around us contains thermal energy and this thermal energy – or heat – is captured by the heat pump and transferred into a building.

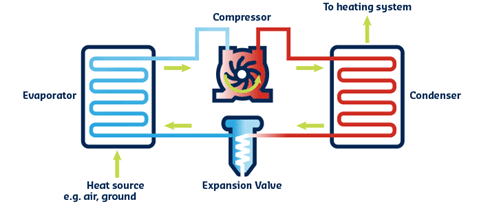

In a heat pump, a refrigerant is passed through a heat exchanger outside a building where it absorbs thermal energy from the air (or from water or the ground). The refrigerant will typically flow at temperatures well below 0°C and so can easily absorb energy even in the winter. The refrigerant is then pumped into a compressor which increases the pressure causing the refrigerant to increase to temperatures typically above 60°C. It then passes into the building and through another heat exchanger where the thermal energy is transferred to water (or air) which is then circulated through the building to provide heat. The refrigerant meanwhile flows through an expansion valve where it cools again before travelling outside to collect more thermal energy.

Energy is used to power the fans and compressors in a heat pump, but the system produces more energy than it uses because it captures thermal energy from outside. A-rated gas boilers manage to convert 90% of the chemical energy in the gas into useable heat. Heat pumps should be at least 300% efficient - delivering three times as much energy as they use. What’s more, if the electricity that the heat pump is using comes from renewable resources, it can be considered to be a close to zero-carbon technology. According to the International Energy Agency, replacing 30% of the global heating market with heat pumps would reduce total global greenhouse gas emissions by 4%.1

How they compete with other technologies

While heat pumps are superior to gas boilers from an efficiency point of view, there are other issues to consider. Historically, heat pumps have not been able to generate the high-water temperatures that gas or oil boilers can. To compensate, buildings using heat pumps need to be better insulated and have had to use larger radiators or underfloor heating – not always practical if you are retrofitting an existing building. However, newer heat pumps can heat water to 70°C degrees meaning that internal radiators do not need to be replaced. They can also be run in reverse providing cooling in the summer and then heating in the winter.

Despite the hype, green hydrogen used in fuel cells is not a realistic technology for heating buildings. According to a recent meta-study hydrogen in heating is less efficient, more expensive and bears a higher resource burden than heat pumps.2

Do heat pumps cost more?

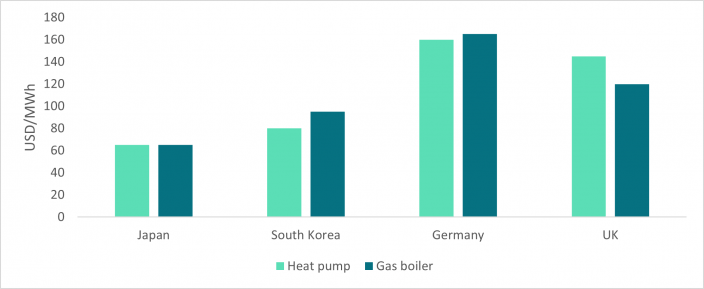

The higher upfront costs of heat pumps have been a challenge as these have typically outweighed the efficiency benefits. In many parts of Europe, inflated gas costs due to the Russian invasion of Ukraine have meant that the total cost of ownership of heat pumps is now often below that of a typical gas boiler. This is already the case in several other regions of the world (see figure 2). Many governments are also providing incentives to home and business owners to install heat pumps. The US’s Inflation Reduction Act, for example, has ear-marked $12.5bn to support heat pump installations. In the US the subsidy is $8,000 per heat pump.

In the UK a subsidy of £5,000 is still not generally sufficient to make the technology fully competitive with traditional heating technologies.4 The UK in fact has the lowest rate of installation of heat pumps of any European country in 2021. Just 1.48 heat pumps were installed per 1,000 households in 2021. Hungary was next lowest at 1.8 per 1,000 households. Norway installed nearly 50 per 1,000 households. The reasons for the UK’s poor performance are partly due to the high relative cost of electricity compared to gas, and because of the lack of capacity in the market to install heat pumps.5 The UK has only 3,000 trained heat pump engineers. We need 27,000 in the next six years.6

What is the size of the market and how fast is it growing?

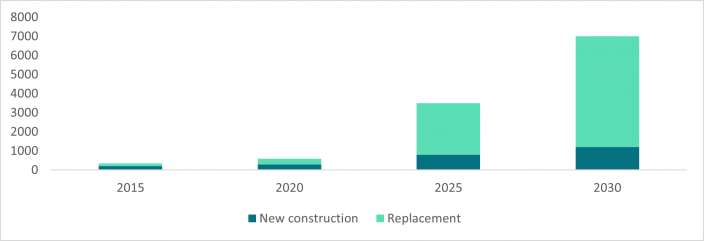

While heat pumps have been very popular in Scandinavian countries for some time, the environmental and economic advantages of heat pumps are now turbo-charging demand. This is particularly the case in Europe where country after country has reported growth rates of 100% in the past year. The Polish and Dutch markets are expected to have doubled in 2022. Finland reported market growth of 80% in the first half of last year with Germany +53% and Italy reporting growth of 114% over the same period.7 Even mature markets like Norway grew more than 10% in 2022. Daikin Industries, a major heat pump manufacturer and WHEB portfolio holding, forecasts the European residential heat pump market to grow from just over 600,000 units in 2020 to 7m units by 2030.8

In the US too, alongside the IRA-linked subsidy, states like California are banning the use of gas heating. Penetration rates which have historically been around 20% are expected to increase to up to 50% over the next five years.9

How WHEB invests in heat pumps

Until recently, heat pumps were considered by most investors to be a niche technology with little expected growth. In contrast WHEB’s thematic research had identified heat pumps as an important solution to the challenge of decarbonising heating in buildings. For example, we owned Nibe Industrier for many years. More recently we have focused on companies that have a strong position in the air-source heat pump market. This includes the Japanese company Daikin Industries that is among the top two manufacturers in the global market. We have also invested in Trane Technologies a leading provider of heat pumps to the North American market. In our European portfolio we have invested in Ariston Group a provider of building heating systems including heat pumps.

While none of these companies are ‘pure-play’ heat pump manufacturers, heat pumps represent a material portion of their revenues and are a clear strategic focus for them. Daikin recently devoted an entire investor presentation to the topic and at the start of 2023 Ariston completed its acquisition of a major German supplier of heat pump technology. These companies, in our view, are all very well-placed to benefit as the market for heat pumps continues to rapidly expand.

Sign up here to recieve our monthly and quarterly commentaries in your inbox.

1 https://www.iea.org/reports/heat-pumps

2 http://www.janrosenow.com/uploads/4/7/1/2/4712328/is_heating_homes_with_hydrogen_all_but_a_pipe_dream_final.pdf

3 https://www.daikin.com/-/media/Project/Daikin/daikin_com/investor/data/others/Sustainability_20230119_2.pdfrev=-1&hash=AAA75DAF1695AD82302359A8EFF8AB98

4 See for example the Financial Times analysis https://www.ft.com/content/9409212a-8b60-481a-9bce-fd42f9d614f8?shareType=nongift

5 https://www.newscientist.com/article/2328095-uks-slow-heat-pump-efforts-will-take-600-years-to-meet-2050-target/#:~:text=UK's%20slow%20heat%20pump%20efforts%20will%20take20years%20to%20meet20target,-Figures%20from%20the&text=The20had%20the%20worst,emissions%20produced%20by%20heating%20homes.

6 https://www.nesta.org.uk/blog/the-heat-pump-installer-gap/

7 Morgan Stanley

8 Op. Cit. iv

9 Based on WHEB expert interview