We’ve been warned – climate crisis and weak links in the supply chain

Whether you’ve tried to fuel up your car recently, were warned by a friend to buy your Christmas presents in August, or are currently waiting over a month for the new iPhone 13, you’ll know that global supply chains are facing severe disruption.

Many news outlets and politicians have been quick to blame the easy target and reassure us that this is just a temporary glitch. They’re not entirely wrong – COVID-19 has led to significant labour shortages which have shut down manufacturing plants across the world and taken swathes of truckers off the roads. But truthfully, the reasons behind this year’s supply chain disruption are complex and manifold. They include extreme weather events; unprecedented (and growing) demand for climate transition technologies; and the creeping gloom of Sino-Western geopolitics… and they’re not going away.

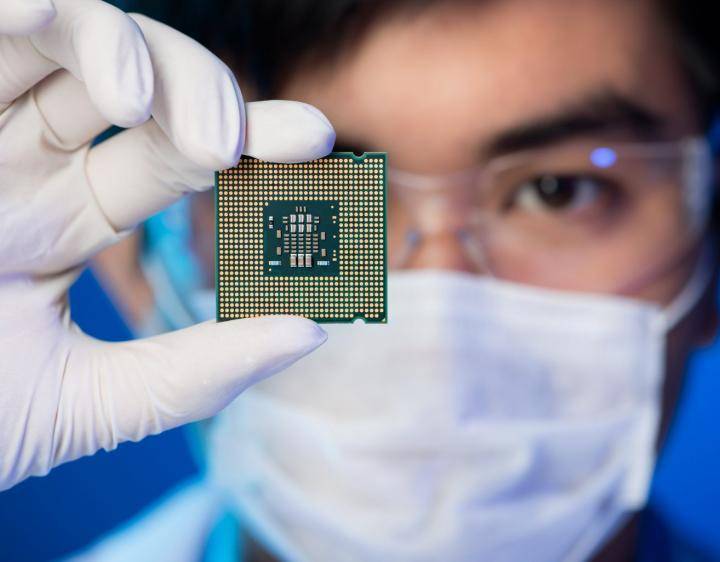

In February, severe winter storms caused massive electricity failures in Texas. Texas is the centre of semiconductor manufacturing in the US, with more facilities than any other state. These clever little chips power most of the world’s transition technologies, including electric vehicles, renewable energy, and energy-efficient home appliances.

The Texas Freeze led to significant lost production for semiconductor manufacturers like Infineon, in our portfolio, and the echoes are still reverberating through supply chains today. In a world where extreme weather events are becoming uncomfortably common, physical asset risk from climate change needs to climb up corporate and investor agendas.

We met with Infineon this month to discuss their asset risk mitigation strategies. We were reassured to learn that they had audited their organization for physical climate risk and had hired a third party to oversee the process. Disclosure could be better though, and we are concerned that Infineon may be underestimating its risk. This will remain an ongoing topic of engagement with Infineon and throughout our portfolio.

On the other side of the equation, demand for climate transition technologies is running hot. Electric vehicles have doubled their share of global car sales in the last 12 months1. Solar and wind capacity additions are running about 50% higher than pre-pandemic levels, and will need to continue a rapid growth trajectory if we are to meet the Paris goals2. This means significantly higher volumes of semiconductors and raw materials being channeled towards transition technologies.

Silver isn’t often mentioned as a critical raw material, yet solar panel manufacturers guzzle up 10% of global silver production and are estimated to need seven times more by 20353. The differentiated manufacturing process employed by First Solar, the PV module manufacturer in our portfolio, thankfully doesn’t use silver. First Solar isn’t immune to potential capacity constraints from other materials however, like copper, aluminium, and steel.

Steel is of particular concern since it is practically ubiquitous within climate transition technologies. Nearly 50% of global steel production happens in China4. The Chinese steel industry is aiming to peak its greenhouse gas emissions by 2025. With steel decarbonization technologies still nascent, China is having to cap domestic production to meet its target. For a country growing as fast as China, this can only mean one thing: hoarding steel.

China has already revived taxes on steel exports to keep more supply at home. The CEO of Lennox, a HVAC manufacturer in our portfolio, recently lamented that steel costs four times more than it did 18 months ago, and blamed ‘the oligopoly that is the steel industry for keeping supply down’. Steel importers need to make a decision – absorb the higher prices, find alternatives, or seriously ramp up domestic steel production (and, with it, steel decarbonisation technologies).

We shouldn’t believe anyone who claims that this year’s supply chain disruption is just a transitory phenomenon resulting from Covid. We have been given a clear warning signal for what’s to come if we don’t manage physical asset risks from climate change and reshape global supply chains to meet the immense demand for transition technologies. Some jurisdictions, including the US, seem to be waking up – the Biden administration has established a Supply Chain Disruptions Task Force which seeks to secure crucial materials supplies. The task is enormous, but with the right support from companies, governments, and investors, it is not insurmountable.

2 https://www.iea.org/reports/renewable-energy-market-update-2021