Much ink has been spilt announcing net-zero carbon (NZC) targets over the past few months, with WHEB no doubt contributing more than our fair share. A recent survey of UK businesses, for example, found that 52% of respondents worked for businesses that had already set a NZC target.1 A proportion of these announcements will doubtless amount to rather little. Greenpeace believes that we are currently living in ‘a golden age of greenwash’.2 Certainly, some companies have been more focused on setting ‘aims’ rather than ‘commitments’ and have been pilloried by NGOs and investors alike.3

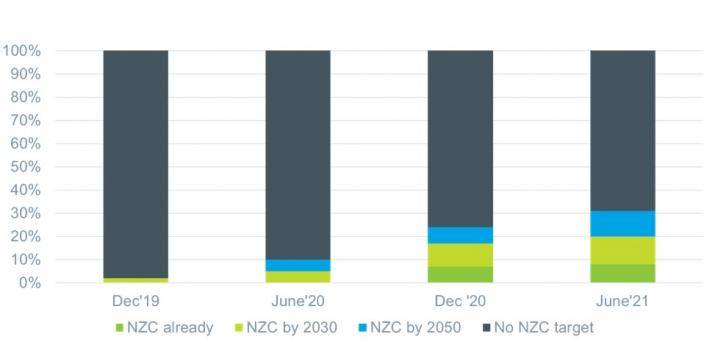

Within the WHEB strategy, as of the end of June 2021, companies representing approximately 8% of the portfolio have already achieved net-zero carbon emissions though admittedly relying heavily on carbon off-sets. A further 12% has committed to achieving net-zero carbon emissions by 2030 and a further 11% is committed to the same target but by 2050 at the latest. These numbers have increased rapidly in the pat eighteen months (see Figure 1).

The hard work begins here

Stating NZC commitments, let alone ambitions, is the easy bit. Delivering them is going to be altogether harder. There is, however, evidence that many companies are serious. Bloomberg reported that in the first six months of 2021, 600 companies had joined the Science-Based Targets Initiative.4 This is more than signed up during the whole of 2020. At this rate more companies will join this initiative in 2021 than in the previous three years combined.

The Science-Based Targets Initiative (SBTi) is a partnership between CDP, the United Nations Global Compact as well the two environmental groups the World Resources Institute and WWF.5 Their explicit objective is to ensure that best practices are used to set emission reduction targets and are in-line with climate science. WHEB regularly recommends to investee companies that they develop targets with the SBTi. Four portfolio companies – DSM, Ecolab, Linde and Smurfit Kappa – have already gone down this route. Together these four are responsible for approximately 60% of the strategy’s scope 1 and 2 carbon intensity.6 A further group of three companies (Hikma, Intertek and Kion) accounting for approximately 5% of the strategy’s carbon intensity, have also publicly committed to working with the SBTi on their own emission targets.

The devil in the detail

Targets are great, but we need to see the detail on how the targets will be achieved. So far, relatively few companies have provided this. We have though seen evidence of more innovation – and communication – around new low and zero carbon technologies. Wabtec, for example, is in our Sustainable Transport theme and sells rail equipment, wagons, carriages and locomotives. The company has recently announced a series of joint ventures and pilot-test initiatives deploying new low carbon technologies. These include trialing new electric locomotives with BNSF Railway Company and hydrogen fuel cell solutions with GM. They are also rolling out new digital technologies to improve rail efficiencies with CSX Corporation. These are all aimed at reducing scope 3 emissions.7 So far though, the company has only set targets on carbon intensity rather than the absolute carbon reduction targets that are urgently needed.

JB Hunt, is also in our Sustainable Transport theme because their largest ‘intermodal’ business shifts freight from road to rail. The company has published a 17 page ‘Climate Action Plan’ in which it clearly sets out the challenge and the opportunity that they face.8 An opportunity because their main business delivers significant carbon reductions to clients by enabling their products to travel by rail rather than by road. But a challenge because rail still produces carbon emissions as does their road-haulage fleet. The company has not yet set a science-based target because they are heavily dependent on heavy duty road haulage vehicle manufacturers and train companies bringing forward zero and low carbon technologies.

Technology development is needed in other sectors as well. Smurfit Kappa, in our Environmental Services theme and part of the paper and packaging sector, has set out details on their carbon reductions strategy. For their mid-term 2030 target, the company is relying on routine efficiency improvements as well as some capital projects that generate carbon reductions alongside wider business benefits. Further reductions will come through the ongoing greening of the electricity grid. But for more substantial reductions beyond 2030 there will need to be significant progress in new zero carbon technologies particularly in the production and use of green hydrogen.

Keeping the pressure up

We are reasonably pleased with the response to our engagement from portfolio companies thus far. Heavier industry sectors that we have exposure to are in many cases the furthest ahead in developing effective strategies. We’ve also seen a greater strategic priority being given to this issue. At JB Hunt, for example, the company’s Chief Operating Officer has taken the reins on the company’s sustainability strategy. And at Daikin, ‘achieving carbon neutrality’ was the first of three strategic aims in the company’s new ‘Fusion25’ strategy.

But there is still an enormous amount to do. 60% of WHEB investee companies have still not committed to a NZC target. We are actively engaging with the majority of these companies and hope that we will see significant further progress in the second half of 2021. If we do not, we are quite prepared divest our position. We spent two years engaging with China Everbright Environment Group to encourage a more proactive approach to carbon emission reductions. Ultimately the company was not willing to set such targets. We think this is bad for business and bad for the planet and consequently we sold our shares in the business at the end of June.

2 https://www.greenpeace.org.uk/news/golden-age-of-greenwash/

3 https://www.ft.com/content/83edfedd-77e7-4877-a016-b00b6b6d0307

4 Nathaniel Bullard, ‘2021 is already better than 2020’, Bloomberg Green, 8th July 2021

5 https://sciencebasedtargets.org/about-us

6 Scope 1 emissions related to direct emissions from the burning of fossil fuels by a company. Scope 2 relates to the greenhouse gas emissions associated with the direct use of electricity by a company.

7 Scope 3 relates to greenhouse gas emissions from a company’s value chain including from suppliers and also from the use of products by customers.