The past few years have been a tough time to be an impact-driven investor. We touched on this in our December strategy update at WHEB’s Annual Investor Conference1. In this article, we want to expand on the point that the extensive dislocation in the impact market is creating one of the most attractive hunting grounds for investors in more than a decade.

Impact investing moved out of favour…

Let’s remind ourselves briefly why impact investors in listed equities have struggled over the past 3-4 years after having been the darling in an “ESG and sustainability stampede” just before that2.

- Over the past 4 years, the MSCI World index has been increasingly taken over by the so-called ‘magnificent seven’ which have performed very strongly but are not investible for a true impact strategy. Overall, the overlap of the WHEB universe and the MSCI World is minimal – ~15%.

- The world has seen a deeper pandemic than anticipated, a war in Europe, sky-rocketing inflation, a cost-of-living crisis, a supply-chain crisis, and the re-election of Donald Trump. A flourishing impact agenda sadly stalled and impact investing fell out of favour. Other topics became more important than saving the planet…

For a fuller discussion of these points please see our article from December ‘It’s always darkest before dawn’.

… but the sustainability-issues are as pressing as ever…

As much as the pendulum might have swung a bit too strongly in favour of impact and ESG during the stampede, the current recoil has clearly gone to the opposite extreme which makes us excited about the outlook.

It’s important to recognise that while many sustainability-related stocks have been hit hard in the current apathy towards this topic, the above mentioned extra-ordinary events and outright policy hostility in the US, the issues these companies are addressing are as pressing as ever. Realistically , the 1.5°C target has slipped out of reach and current policies would lead to a catastrophic temperature increase of 3.1°C.3 The world is getting a taster of the consequences ever more frequently with deadly hurricanes Helene and Milton in Florida (Sept’24), flooding of Valencia in Spain (Oct’24), Southern California wildfires (Jan’25), flooding in Emilia-Romagna in Italy (Mar’25), and the collapse of the Birch glacier in Switzerland obliterating an entire village (May’25) to name just a few. The associated annual insurance payouts for natural disasters are on a steadily rising trajectory (5-7% annual rise) well above inflation.4 Munich RE’s annual natural disaster review leaves no doubt what they see as the cause.5

… and thankfully the world is not quite standing still

While the Trump administration aims to shoot down the energy transition agenda, many individual US states remain committed to it. It was refreshing to read that a proposed law in the oil state Texas to limit renewable power projects failed to get enough Republican support.6 In fact, 24 US states committed to the Paris Agreement goals in January 2025 after President Trump announced the US’ withdrawal.7 The net-zero commitments in other parts of the world (eg the EU) remain entirely intact.

Sustainable transport is a key enabler of the energy transition. And while there is a lot of noise around Tesla’s electric vehicle (EV) shipments declining strongly in Europe, the underlying EV market has actually started to grow again.8

Similarly, there is a lot of concern regarding renewable energy investments in the US on the back of the house-approved reconciliation bill. And quite rightly. But, as we argue further below, while rescinding parts of the Inflation Reduction Act (IRA) will inevitably be a set-back, there is now meaningful resistance to the anti-renewables narrative in the Republican party at state as well as federal level. Secondly, state-level subsidies/tax incentives are unaffected by the bill and the commitment of many large US companies to switch to clean energy remains unchanged. Only pockets (eg US airlines) have used Trump’s negative stance to back away from their own commitments.

Lastly, we shouldn’t forget that our strategy also has a strong commitment to social sustainability themes with health care by far the largest. Here again, President Trump created shock waves in the appointment of RF Kennedy Jr. as the US Health and Human Services chief and his verbal push for a “most favoured nation” (MFN) approach to drug pricing on 12 May 2025. This approach would potentially upend the current system of drug discovery. The executive order which followed confirmed that there is no realistic plan for immediate implementation of the order, which calmed nerves.9 The reality is that these changes will be extremely difficult to implement.

Relative valuations have never been cheaper

Let’s put some meat on the bone and illustrate how these challenges have impacted the valuation of our portfolio and investment universe. Put simply, valuations have rarely been lower.

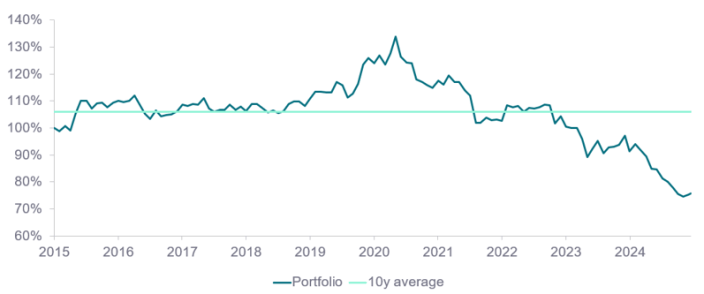

This is illustrated below for the portfolio using for example the price book ratio, or multiple, relative to local markets. The price to book ratio is the ratio of the stockmarket value of a company, to the company’s book value (ie total net assets on the balance sheet). We then express this as a percentage of the equivalent ratio for the whole of the stock’s local stockmarket.

So, for example, if a US stock as a price to book multiple of 3x, and the market average is 2x, this measure would be 150%. As investor confidence in a stock increases, so its multiple will expand, and if confidence in the rest of the market doesn’t increase by the same amount, so that premium will increase, or any discount decrease.

In the chart below, we have tracked this measure for the whole portfolio over a ten year period, having rebased it to 100 at the start of the period. The data is clear: the market’s confidence in our portfolio, and the sustainability themes it represents, grew and grew until 2020…. But since then, has fallen continually, and is now testing new lows. Other valuation metrics show a similar trend.

Figure 1: Portfolio price-to-forward-book ratio, relative to local markets, rebased10

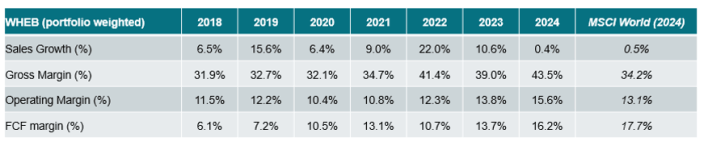

The cynic might wonder whether this could be due to the WHEB strategy investing increasingly in lower quality names which derated more strongly as a result of those weak fundamentals. This has not been the case – the portfolio fundamentals have remained consistently strong and healthy and in fact mostly ahead of the MSCI World in the latest reported year of 2024.

Figure 2: Portfolio fundamentals - Underlying strength11

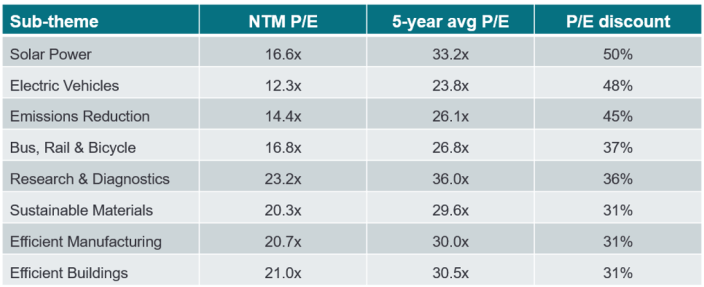

And the observation of a severe derating of valuation is not portfolio-specific but extends to a number of themes within our investment universe as shown below. For example, relative to its five-year history, the solar sector’s price-to-earnings ratio has halved. The “Electric Vehicles” (EV) sub-theme is not far off that level and neither is “Emission Reductions”. This creates opportunities - we continue to be convinced that the future of electricity generation is renewable, the future of transport is electric12, and the transition to a low-carbon economy is imperative to secure a liveable planet.

Figure 3: Value opportunities in the universe13

Quality companies at very cheap prices

It might be worth going through a few stock examples where we see a large dislocation between the current price and our target price. The common denominator is that while the company is currently experiencing a challenging situation we see this as temporary and expect the valuation gap to narrow over time.

- Croda is a specialty chemicals company operating in personal care, crop care, health care and industrial end markets. Its raw materials are primarily bio-based avoiding the oil-based alternatives. The company suffered from an extended period of destocking post Covid and weaker economic conditions globally resulting in underutilisation and therefore margin pressures. Croda’s product portfolio remains highly relevant and attractive and the company is pursuing more stringent cost management to bolster margins again.

- First Solar is the world’s only significant thin film solar PV panel manufacturer and a key solution provider to the energy transition. It has a sizeable and growing production capacity in the US and therefore greatly benefits from the IRA. However, the election of President Trump and his anti-renewable energy (RE) agenda includes the aim to dismantle the IRA. His “One Big Beautiful Bill Act” which got approved by the house has taken its toll on the entire RE space including First Solar. Whether the current version of the Bill is passed is hotly contested and clearly if the Senate is successful in staving off the most aggressive cut-backs RE companies will strongly benefit. However, even in a worst-case scenario in which the Bill passes as is, there is still modest upside to the current valuation, in our view.

- ICON is a clinical research organisation (CRO) which helps the pharma and biotech industries in developing new therapies more quickly and at a lower cost. There had been a slump in biotech research funding post Covid and green shoots emerging in early 2024 did not prosper as expected. This was combined with large pharma budget constraints this year, taking a toll on the entire CRO market, including ICON’s main competitor IQVIA. These are all highly transient obstacles. The underlying drug R&D pipeline is healthy14 and the outsourcing trend towards CROs remain intact15. ICON is a market leader in this space and bound to benefit when the market normalises again.

In conclusion…

The valuations of impact-related stocks have rarely been cheaper driven down by extra-ordinary one-off events and a populist political agenda in some key markets. As painful as the past few years have been, we are super excited about the growth and performance prospects across our portfolio and the investment universe16.

We are not alone in recognising the urgency of taking actions to drive forward sustainability and abate climate change – it has never been greater. Many countries, US States and individual companies remain committed to the environmental agenda despite past and present obstacles. With that backdrop, if the market doesn’t think these companies have a bright future, it’s a great opportunity. Let’s go hunting…

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 https://www.whebgroup.com/our-thoughts/it-is-always-darkest-before-dawn (Dec 2024)

2 https://www.whebgroup.com/our-thoughts/investing-in-breakthroughs (Oct 2020)

3 https://www.unep.org/news-and-stories/press-release/nations-must-close-huge-emissions-gap-new-climate-pledges-and (Oct 2024)

4 https://www.swissre.com/dam/jcr:46617c8b-98a4-4d54-b259-f4bdcbaab0b8/sri-sigma-natural-catastrophes-1-2025.pdf (Page 3, Apr 2025)

5 https://www.munichre.com/en/company/media-relations/media-information-and-corporate-news/media-information/2025/natural-disaster-figures-2024.html

6 https://on.ft.com/4kIchpr

7 https://www.esgtoday.com/24-u-s-states-commit-to-paris-agreement-goals-after-trump-exits-accord/

8 https://www.bloomberg.com/news/newsletters/2025-01-17/why-electric-vehicles-are-poised-for-another-record-year

9 https://www.whitehouse.gov/presidential-actions/2025/05/delivering-most-favored-nation-prescription-drug-pricing-to-american-patients/

10 Note: Mean ratio of price to next reported book value by analysts’ estimates, FP WHEB Sustainability Impact Fund, excluding distortions from meaningless denominator in the case of Autodesk. Source: Factset as of 11/06/25.

11 Bloomberg

12 https://www.whebgroup.com/our-thoughts/evs-are-dead-long-live-evs

13 Note: Mean ratio of price to next 12 months’ earnings (NTM P/E) by analyst consensus based on stocks in the WHEB investment universe as of 08/04/25. Source FactSet

14 https://www.deloitte.com/uk/en/about/press-room/global-pharma-rd-returns-rise-as-one-glp-drugs-help-drive-forecast-growth.html

15 Alpha-sense expert call from 3 April 2025 with a former Syneos Health employee

16 Past performance is not a reliable guide to future results. Your capital is at risk.