If you’ve been following our commentary over the last year, you’ll know that our holdings in the healthcare sector – in particular, pharma companies and their suppliers – have experienced challenging performance.

In 2021, these companies were heroes. Thermo Fisher produced more Covid tests than any other company in the world. AstraZeneca manufactured a Covid vaccine that helped get us out of the pandemic’s grip. ICON, a clinical research organisation, partnered with Pfizer to progress their vaccine’s clinical trials at unprecedented speed.

But much like any machine that is driven full throttle for too long, the pharma industry burnt out in 2022 following the enormous disruption from the pandemic.

Five years after our first lockdown, when will this industry find its ‘new normal’?

Health is wealth – or is it the other way around?

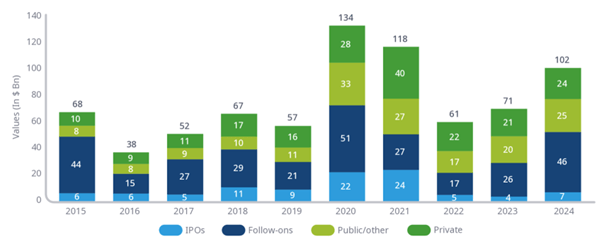

The average cost to develop a new drug is over $2billion1. For this reason, funding for biopharma research is the lifeforce of the industry. The more funding there is, the more work there is for companies like ICON and Thermo Fisher, and the greater the likelihood of a new drug making it to commercialisation.

We saw a massive influx of biopharma funding during the peak of the pandemic. This sharply tapered in 2022 as the world contended with higher interest rates and economic uncertainty, and as large amounts of funding had been expended to fight Covid.

In March, clinical research company IQVIA published their annual update on pharma R&D2. We were strongly encouraged by the return to funding growth shown in their data, implying the industry’s possible return to health.

Biopharma funding levels US$Bn, 2015-2024

Source: BioWorld, Janaury 2025.

Trump’s policies may be a bitter pill to swallow

While this data is encouraging, we cannot yet give the pharma industry a clean bill of health.

Almost every industry in our portfolio has suffered to some degree from Trump’s obstinate approach to trade negotiations. Given the often life-saving impact of many pharmaceutical therapies, one might have thought that these products might have been exempted from horse-trading over tariffs, but sadly not.

The sector’s share prices have whipsawed this month as we await a likely implementation of US import taxes on pharmaceuticals.

Tariffs are not the only means by which Trump has targeted pharmaceutical companies. His administration directly cut funding to the National Institute of Health (NIH)– cutting nearly 700 grants, worth around $2billion, in just 40 days3. A ‘Most Favored Nations’ policy, which aims to cut drug prices for Medicare patients, similarly seeks to cut American spending on healthcare.

The NIH is overseen by the US Health Secretary, in this case Robert F Kennedy, who has been known to share spurious and poorly evidenced views on healthcare issues.

However, the bigger force at play here is President Trump’s trade negotiations – his aim is to force Europe to carry a greater share of global R&D investment, and he hopes to achieve this by cutting US spending.

This has spooked the sector. What had looked like a healthy recovery in 2024 is now looking less certain.

Portfolio thoughts

Around 20% of our portfolio is in companies that create pharmaceutical therapies, or provide services and support to healthcare R&D.

We do not invest directly in small cap biopharma companies, which are most vulnerable to funding cuts. Our larger pharmaceutical companies, such as AstraZeneca, are much better placed to navigate this difficult geopolitical environment and to fund their own R&D from their profits.

AstraZeneca will be able to manufacture most of what they need on US soil, and the company continues on its mission to launch 20 new medicines by the end of the decade. They believe this will help them reach $80billion in revenue by 2030.

However, our R&D service providers such as ICON and Thermo Fisher are experiencing second order effects from the difficult funding and political environment.

That notwithstanding, the onward march of larger companies like AstraZeneca implies that there will remain healthy demand for these companies’ services in the years to come. Astra has a massive pipeline of new drugs currently in development, particularly in oncology, where their aim is for 50% of all cancer patients in 2030 to be treated with one of their medications.

While the pharma industry may not yet have found its ‘new normal’, we believe the pressing need for pharmaceutical innovation, and the commercial opportunity for companies like Astra, will create continued healthy demand and profits growth in this industry over the long term.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 https://www.deloitte.com/uk/en/about/press-room/global-pharma-rd-returns-rise-as-one-glp-drugs-help-drive-forecast-growth.html

2 https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/global-trends-in-r-and-d-2025

3 https://www.reuters.com/business/healthcare-pharmaceuticals/trump-administration-health-research-cuts-total-18-billion-analysis-finds-2025-05-08/