Time to Adapt - The reasoning behind WHEB’s new sub-theme: Climate Adaptation

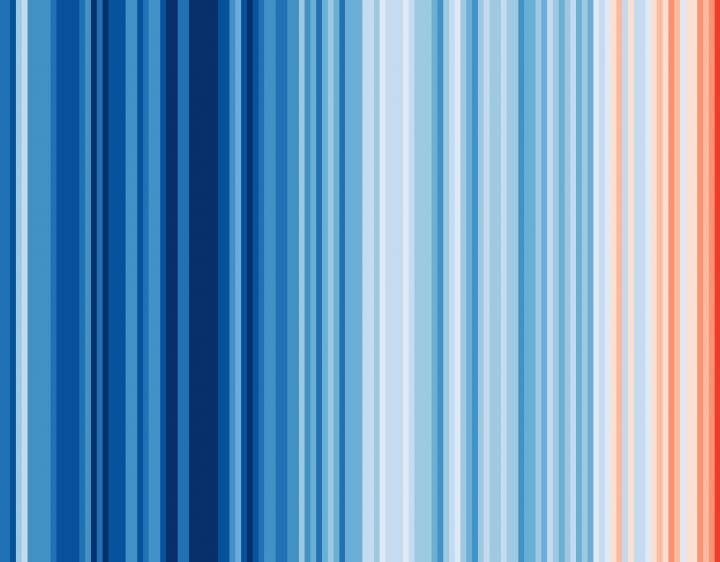

Another year, another red stripe

Many of our readers will be familiar with the above image – especially if they have seen Seb, our Head of Research lately, who’s had it made into an… *ahem*… attractive and thought-provoking tie.

Created by Professor Ed Hawkins at the University of Reading, the Climate Stripes show a series of coloured vertical bars, each depicting the average global temperature for a single year. Shades of blue indicate cooler-than-average years1. Red shows years that were hotter-than-average.

2023 was the warmest year on record by a large margin. “I think I need a new colour”, reflected the Professor.

Climate change costs more than money

It is well established that rising global temperatures are strongly correlated with extreme weather events2.

Carbon Brief, an award-winning climate journal, has mapped and analysed over 400 scientific studies on this subject. They found that over 70% of the extreme weather events studied were exacerbated by human-caused climate change3.

Behind these figures are hundreds of weather events around the world. Each caused tragedy and devastation.

Munich RE, a reinsurance firm, estimates that natural disasters caused $250 billion in financial losses in 2023 alone. Over 74,000 lives were lost4.

Hawaii: 'Apocalyptic' wildfires leave at least 53 dead on island of Maui5

We need to adapt

The world is not investing enough to prevent climate change. The result is an ever-hotter climate and increasing natural disasters.

And make no mistake – it is killing people.

We investors do what we can. We buy shares in impactful companies. We engage with corporations to reduce their emissions. We work with policymakers to accelerate change.

But we also need to accept the reality we find ourselves in.

With that in mind, WHEB has formally established a Climate Adaptation sub-theme in our investment strategy. This forms part of our Environmental Services theme.

Importantly, this new sub-theme changes nothing about how our strategy is managed. In fact, we have been investing in adaptation for years.

Rather, it formally acknowledges the crucial role of adaptation investment.

It also, potentially, creates opportunities for new companies to enter our investment universe. For example, we recently spoke to a company which has experienced rapid growth from selling hurricane-resistant windows in Florida.

Investing in Climate Adaptation

Today, about 5% of WHEB’s global fund is invested in companies supporting climate adaptation6.

My favourite is probably Advanced Drainage Systems (ADS). This remarkable company sells plastic stormwater pipes in America.

The company’s products are crucial for helping communities become more resilient to flooding. ADS has seen huge revenue growth and margin expansion as its products are increasingly seen as critical infrastructure.

Environmental consultants Arcadis are another example of an investee company supporting climate adaptation. They have been working on projects to shore up flood defences7; transform concrete jungles into green spaces8; and create stormproof sewers9.

Arcadis has seen rapidly increasing demand for its services over the last few years.

Spend now, save later

Investing in climate adaptation does not mean we are admitting defeat. Spending on mitigation measures like cleaner energy must, and will, continue.

But it is important to realise that investing in climate-resilient infrastructure today can avoid even greater costs in the future.

The UN estimates that spending $1.8 trillion on a variety of adaptation projects could generate four times that amount in avoided costs and benefits10.

And, more importantly, these investments could save lives. That is surely invaluable.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 The average temperature is set as the average temperature between 1971-2000.

2 https://www.ipcc.ch/report/ar6/syr/

3 https://www.carbonbrief.org/mapped-how-climate-change-affects-extreme-weather-around-the-world/

4 https://www.munichre.com/en/company/media-relations/media-information-and-corporate-news/media-information/2024/natural-disaster-figures-2023.html

5 https://www.itv.com/news/2023-08-09/hawaii-people-jump-into-sea-to-escape-apocalyptic-wildfires

6 As of December 31, 2023.

7 https://www.arcadis.com/en-gb/projects/north-america/united-states/redefining-adaptation-to-build-a-fit-for-future-coastal-community

8 https://www.arcadis.com/en-gb/projects/europe/france/forets-urbaines-a-paris

9 https://www.arcadis.com/en-gb/projects/europe/netherlands/op-weg-naar-een-klimaatbestendig-utrecht

10 https://www.un.org/en/climatechange/climate-adaptation