The return of the rational optimist

After two years of volatility, Q2 earnings reports are delivering something markets haven’t seen in a while: clarity.

While we’re only a few weeks into earning season, there have been few surprises, and that’s a good thing. The tone from companies has shifted away from crisis management. It's now about resetting expectations and looking ahead.

In short, we’re beginning to see the long-overdue return of rational optimism.

Crucially, this optimism isn’t based on sentiment. It’s grounded in fundamentals, and increasingly those fundamentals are pointing forward.

From paralysis to planning

For much of the post-pandemic era, markets were caught in a holding pattern. Businesses focused on navigating short-term pressures. Inflation, geopolitical instability, and inconsistent policymaking made long-term planning exceptionally difficult.

That’s now beginning to change.

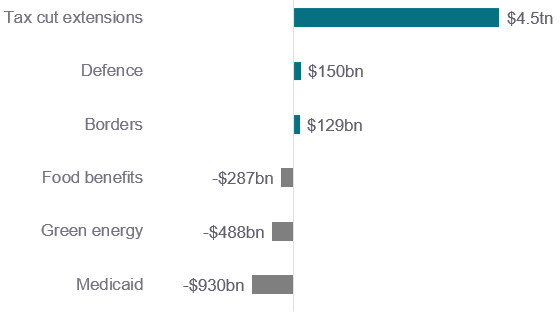

The passage of Trump’s ‘One Big Beautiful Bill Act’ hasn’t exactly enthused the sustainability space. The bill is far from climate-friendly, with a strong tilt towards extended tax cuts and a sharp pullback in healthcare and clean energy support. Most notably, a $930bn1 reduction in Medicaid over the next decade and a rollback of EV incentives.

Figure 1: Key items in Trump’s One Big Beautiful Bill2

In spite of this, its arrival has brought a degree of relief.

For months, uncertainty around the scope and direction of fiscal policy kept businesses in a defensive crouch. While many view the bill’s content as regressive, it has at least removed the element of surprise. Clearer budget trajectories and legislative priorities means companies can start to plan with greater confidence again.

Stabilisation before acceleration

Few sectors felt the post-pandemic whiplash harder than the life science tool manufacturers; suppliers of critical instruments used in biotech research and diagnostics. As my colleague Claire Jervis recently highlighted, the landscape has been challenging: delayed biotech funding, cautious pharma pipelines, and significant budget volatility all weighed heavily on demand.

The narrative may now be shifting.

Thermo Fisher, the world’s largest provider of scientific instrumentation, saw its stock rise 18%3 during the week it reported. Beyond the solid report, the key takeaway was management's revised growth guidance4: 3-6% core growth in 2026/27 and 7%+ beyond. While this is lower than previous 7-9% targets, the market viewed the announcement positively as a realistic reset given the fundamental drivers in the industry.

ICON, a leading provider of outsourced clinical trials, also offered early signs of recovery. As my colleague Ben Kluftinger previously outlined, the company faced challenges from delayed project commitments, due to biotech funding gaps and cautious pharma R&D spending. In Q2, however, there were clear signs of stabilisation: project wins were up 11%5 from Q1, biotech bookings exceeded expectations, and long-term oncology partnerships regained momentum. While management still offered a cautious tone, the results suggest that the worst may be behind them. ICON’s stock rose 30%6 in the week of its report.

Clean energy, too, is showing resilience. First Solar, a key player in US solar manufacturing, faced significant uncertainty as the 45X manufacturing credit came under threat from proposed subsidy rollbacks. Encouragingly, policy shifts now appear less immediate and slower-moving than initially feared. Q2 results helped ease some of these concerns. Bookings remained strong, pricing held firm, and demand showed no signs of slowing. While policy risks remain, clearer direction on subsidies is allowing both the company and its customers to plan with more confidence.

Together, these developments show that companies are no longer operating in the dark, with early signs of a measured and long overdue sustainable turnaround.

A clear valuation discount

What makes this moment particularly compelling for long-term investors is the growing disconnect between improving fundamentals and valuations.

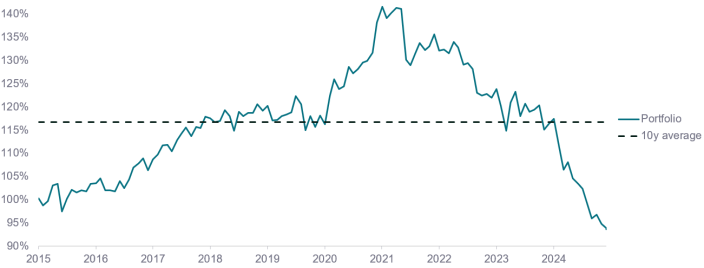

Many high-quality businesses with long-term growth prospects, especially those aligned with sustainability, are trading at steep discounts. The forward price-to-earnings ratio of the portfolio is now well below its 10-year average and at the lowest level in a decade.

These businesses remain underappreciated, largely due to the lingering volatility of 2023/24. As fundamentals improve and political noise settles, this discount looks less like caution and more like mispricing.

Figure 2: Portfolio forward P/E ratio, relative to local markets, rebased7

The bigger picture: From fog to focus

So what to take away from all this? The landscape is still mixed, but it’s no longer quite as chaotic. The market is transitioning from reaction to recalibration. This isn’t a moment for chasing momentum. It’s about identifying the businesses that are quietly getting back on track.

Life science tools are resetting. Clinical Research Organisations (CROs) are stabilising. Clean energy, while politically pressured, is finding its footing again.

The fog is lifting. And in this environment, visibility might be the most valuable asset of all.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 BBC https://www.bbc.co.uk/news/articles/c0eqpz23l9jo

2 Congressional Budget Office estimates; BBC https://www.bbc.co.uk/news/articles/c0eqpz23l9jo ; ABC News

3 FactSet as of 25th July 2025

4 Thermo Fisher Q2 2025 Results: https://ir.thermofisher.com/investors/news-events/news/news-details/2025/Thermo-Fisher-Scientific-Reports-Second-Quarter-2025-Results/

5 ICON Q2 2025 Results: https://www.iconplc.com/news-events/press-releases/icon-reports-second-quarter-2025-results

6 FactSet as of 25th July 2025

7 Mean ratio of price to next twelve months’ earnings by analyst consensus, FP WHEB Sustainability Impact Fund, excluding distortions from meaningless or negative denominators in five cases: FirstSolar, Advanced Drainage Systems, Vestas, Silicon Labs, and Autodesk. Source: Factset as at 31/07/2025.